FREE California Overtime Calculator: Quickly Compute Your Overtime Pay

Welcome to our California Overtime Pay Calculator – your go-to resource for accurately determining overtime pay in compliance with California's stringent labor laws.

Use our California Overtime Calculator to effortlessly compute your overtime hours and corresponding pay. Enter your pay rate and work hours above and let our calculator handle the rest.

Understanding California Overtime Law

Whether you're an employer or an employee, our easy-to-use tool will simplify the complexities of overtime calculations in the state of California.

To use the California overtime pay calculator more efficiently, here is a brief overview of the state's law, including eligibility criteria and calculation methods.

Who's Eligible?

California overtime laws cover most employees working in the state. This includes salaried and hourly employees, as well as part-time and full-time workers, unless they fall under specific exempt categories.

The law primarily aims to protect non-exempt employees – those not exempted from overtime pay due to their job duties or compensation level.

Examples of exempt employees include those in executive, administrative, or professional roles, outside salespersons, and certain computer professionals.

How Do You Calculate Overtime in California?

In California, overtime is calculated based on hours worked over 8 hours a day or 40 hours a week. The pay rate is 1.5 times the regular rate for the first 8-12 hours in a day and for the first 8 hours on the seventh consecutive working day.

It's double the regular rate of pay for hours worked over 12 in a day and beyond 8 on the seventh consecutive day.

Defining Workday and Workweek

Understanding what constitutes a 'workday' and a 'workweek' is crucial under California law.

Workday: A workday is a 24-hour period that starts at the same time each day. While it can begin at any hour, once established, the workday must remain consistent.

Workweek: A workweek consists of seven consecutive 24-hour periods, amounting to 168 total hours. Like the workday, a workweek can start any day and at any hour as long as it's fixed and recurring.

Exemptions and Exceptions in Overtime Law

While using our overtime pay California calculator, it's important to understand certain exemptions and exceptions that may apply to your situation.

As both the FLSA (Fair Labor Standards Act) and California Labor Law have provisions defining exempt employees, you must understand both sets of requirements to ensure compliance.

Professional Exemption

Professionals exempt from overtime laws typically include employees in advanced fields who require specialized education. To qualify for this exemption, an individual generally must:

- Earn a salary equivalent to at least twice the state minimum wage for full-time employment.

- Work in a field of science or learning, such as law, medicine, teaching, architecture, engineering, or accounting.

- Primarily engage in duties that require advanced knowledge and consistent exercise of discretion and judgment.

Administrative Exemption

Administrative employees may also be exempt from overtime if they meet certain criteria:

- Their primary duty involves performing office or non-manual work directly related to management policies or general business operations.

- They regularly assist a proprietor or are employed in an administrative capacity, requiring special training, experience, or knowledge.

- They exercise discretion and independent judgment in significant matters.

- Their earnings are more than twice the state’s minimum wage for full-time work.

Executive Exemption

This category includes employees in managerial roles who meet these conditions:

- Their primary duty is managing the enterprise or a recognized department or subdivision.

- They regularly direct the work of at least two or more other full-time employees.

- They have the authority to hire or fire other employees, or their suggestions on hiring, firing, advancement, and promotion are given particular weight.

- They customarily and regularly exercise discretion and independent judgment.

- They are paid a salary equivalent to at least twice the state minimum wage for full-time employment.

Other Specific Exceptions

In addition to these exemptions, some job roles and industries have unique overtime rules. For example:

- Employees in the healthcare industry may have alternative arrangements for shifts longer than 8 hours without overtime compensation if certain conditions are met.

- Collective bargaining agreements can also set different overtime rules for unionized workers.

- Specific professions like outside salespersons, certain types of computer software employees, and others may also be exempt from standard overtime requirements.

PRO TIP: California Meal and Rest Break Laws are also very strict, and non-compliance can lead to penalties. Keep in mind that if an employee works during their meal break, those hours would count as time worked and could contribute to overtime calculations.

Want to learn more about California overtime rules?

- California Labor Law. This article provides an overview of California labor laws, including overtime rules.

- California Overtime Law. Find out which employees are entitled to overtime pay and how to calculate overtime rates.

- California’s Double Time and Overtime Laws. Discover which employees are entitled to double time pay and how to calculate it.

- California’s Alternative Workweek Schedule. This article discusses what the alternative workweek schedule is and how to implement it.

Timeero: Your California Overtime Compliance Solution

Staying compliant with California’s complex overtime laws is crucial to avoiding penalties and legal issues.

Timeero, an automated time-tracking tool, aids you in producing accurate and timely payroll reports. The app also keeps you on track to meet legal deadlines.

What exactly does Timeero have to offer to California businesses?

Custom California Overtime Features

Timeero’s California overtime feature eliminates the guesswork and potential legal pitfalls of interpreting state regulations.

With a single click in the mobile phone app, the tool automatically applies all relevant overtime provisions.

The app automatically calculates accurate pay for overtime and double-time hours, based on employees’ regular pay rates.

Tailor Pay Structures to Your Workforce

Timeero caters to businesses with diverse pay structures. You can simply input each employee’s regular pay rate, and Timeero handles the rest.

Prevent Overtime Violations with Real-Time Alerts

Timeero discourages unauthorized overtime by sending real-time alerts when employees approach overtime thresholds.

.webp)

By leveraging Timeero’s comprehensive features, California businesses can confidently navigate overtime regulations, reduce administrative burden, and focus on core operations.

Effortlessly Track Breaks & Stay Compliant

Timeero’s break tracker helps you maintain compliance with California’s meal and rest break laws.

The Daily Sign-Off functionality allows employees to electronically attest to taking their legally required breaks, providing valuable documentation for compliance purposes.

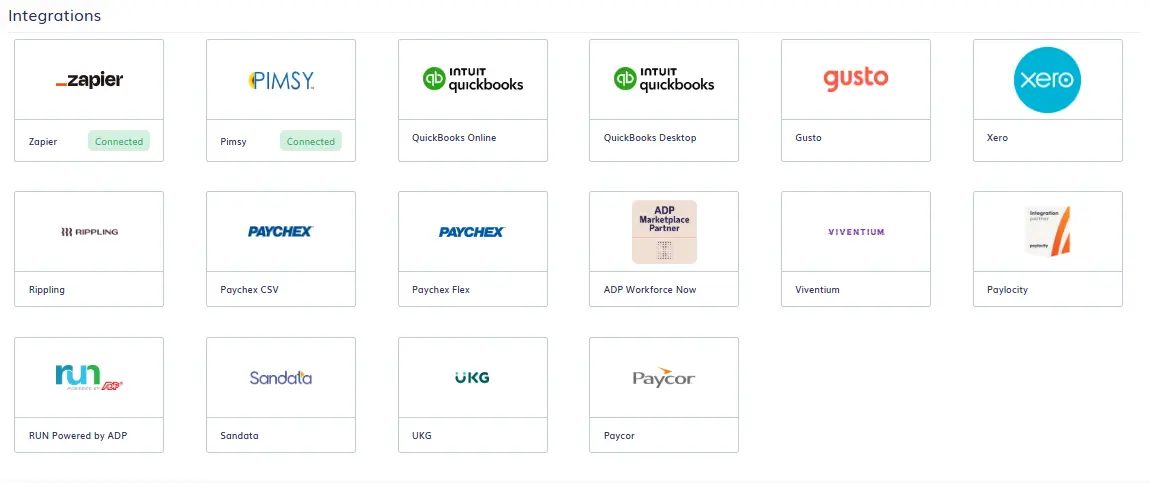

Simplify Payroll & Ensure Legal Accuracy with Integrations

With Timeero, you can generate comprehensive customized payroll reports at the end of each period. Plus, Timeero integrates seamlessly with popular payroll and accounting software, reducing time spent on administrative tasks.

Timeero offers many other features that benefit your business, including real-time location and mileage tracking, segmented tracking, scheduling, and PTO management. To learn more about these features, check out our comprehensive Timeero review or schedule a free consultation with our expert team.

Important note on the California Overtime Calculator

While we strive to provide a useful tool to calculate overtime pay in California, there are certain limitations. When entering hours into the calculator, please include only the actual hours worked. Do not incorporate holiday pay, vacation pay, or any other form of paid time off, as these do not typically count toward overtime calculations. The calculator provides gross pay estimates. This means the figures are calculated before taxes and deductions. The results from the California Overtime Calculator may not be accurate for specific situations, such as salaried non-exempt employees, employees on an alternative work schedule, minors, etc. California Overtime Calculator is not intended to provide tax or legal advice. For specific concerns, please consult with a professional in the relevant field.

California Overtime Calculator FAQs

Is overtime after 8 hours or 40 hours in California?

Both. In California, overtime is due for hours worked beyond 8 in a day and 40 in a week.

Can you work 4 10-hours shifts without overtime in California?

Under the alternative workweek schedule, an employee might be able to work for 10 hours without overtime compensation. However, this is an exemption, not a general rule.

What is overtime pay?

Overtime pay is the additional compensation workers receive for hours worked beyond the standard work period (in California, over 8 hours a day or 40 hours a week).

How do you calculate overtime pay?

Overtime pay is calculated by multiplying the number of overtime hours worked by the overtime pay rate (1.5x or 2x the regular rate).

How much is overtime pay in California?

Overtime pay is typically 1.5 times the employee’s regular rate for certain hours and double for others, as outlined above.

How to calculate overtime pay for salaried employees?

To calculate overtime for salaried employees, first determine the regular hourly rate by dividing the weekly salary by the number of standard hours worked. Then, calculate overtime based on this rate.

What is an overtime calculator?

An overtime calculator is an online tool that helps compute overtime pay based on hours of work and pay rate.

How do I use a California overtime calculator to determine my extra pay?

Simply enter your regular hourly rate and the total number of hours worked, including overtime hours The calculator will then calculate your total overtime pay based on California's overtime laws.

.png)

.png)

.png)