Overtime Pay in Australia (2026): A Complete Employers' Guide

The Australian government has various legal frameworks to ensure fair and equitable employee treatment. One such labor law is overtime pay, which is outlined in the National Employment Standards (NES) and regulated through the Fair Work Act 2009.

In this guide, we’ll explore the overtime laws in Australia. We’ll discuss how overtime works, who is eligible for overtime pay, and how to calculate it. We’ll also highlight how overtime differs from penalty rates and ‘time in lieu’ to eliminate any confusion.

We’ll also reveal the best time tracking app you can use to compute overtime pay for fair employee remuneration and unwavering compliance. Let’s dive in.

Last updated: January 2026

What Is overtime work in Australia?

Overtime work in Australia refers to the extra hours an employee works over the regular work hours in a day or week. In many modern awards, overtime for full-time employees commonly applies when work exceeds 38 hours per week, or daily limits specified in the award.

However, overtime entitlements may change depending on an employee's modern award or enterprise agreement. For example, part-time and casual employees in social, community, homecare, and disability services award are entitled to overtime pay when they work:

- Over 38 hours per week or 76 hours per fortnight

- More than 10 continuous hours in a day or shift

Whether overtime is calculated daily, weekly, or both depends on the specific terms of the applicable modern award or enterprise agreement. For example, the General Retail Industry Award 2010 applies daily overtime rules, meaning overtime is assessed on each workday rather than averaged across the week.

Check the employee award or agreement to confirm how to apply overtime, as exceptions may exist. For starters, a modern award is a legal document that sets out the terms and conditions of employment. The document outlines when overtime applies as well as minimum wage rates.

The Fair Work Act 2009 gives employees in Australia the right to refuse to work overtime. According to section 62 of the act, employers must not require or request employees to work more than the regular or ordinary hours in a week unless the extra hours are reasonable. This then begs the question, what is reasonable overtime work?

What is reasonable overtime work?

Reasonable overtime is assessed against the reasonableness factors outlined in section 62 of the Fair Work Act 2009.For overtime to qualify as ‘reasonable,’ it must take into account factors such as:

- Risk to employee health and safety

- An employee’s family responsibilities and personal situation

- Nature of an employee’s role and level of responsibility

- Whether the employee was given reasonable notice of the overtime requirement

- Terms outlined in the employee’s modern award or enterprise agreement.

Who is eligible for overtime pay?

Generally, an employee covered by a modern award is entitled to overtime pay when they work beyond the ordinary hours defined in that award. However, the eligibility may vary based on the employee’s industry, modern award, and employment contract.

How to calculate overtime pay in Australia

To calculate overtime in Australia, multiply the employee’s overtime hours by the applicable overtime rate specified in the relevant award or enterprise agreement

In this section, we’ll disclose the overtime rates for different situations and use real-world examples to help you compute overtime pay.

Overtime pay for a regular work day

In many modern awards, the overtime rate for a regular workday is paid at the following rates:

- 150% or 1.5x the minimum hourly rate for the first 2 hours of overtime.

- 200% or 2x the minimum hourly rate for hours worked after that in a day.

The law typically defines “regular work days” as Monday through Friday. But, keep in mind that the overtime rates mentioned above apply to the hours of overtime an employee accumulates from Monday through Saturday.

In some awards, overtime rates reset at midnight; however, this treatment varies by award and should always be confirmed against the applicable instrument. In practice, this means that depending on the award, working long hours does not always guarantee double-time rates.

Some awards contain exceptions to midnight reset rules.The first is when overtime extends past midnight into Sunday or a public holiday. The second is when an employer agrees to pay employees 200% of their regular pay rate for overtime, which extends past midnight.

Overtime pay on Sunday and a public holiday

Under many modern awards, overtime worked on Sundays or public holidays is paid at higher rates, such as:

- 200% or 2x their minimum hourly rate for all hours worked on Sunday.

- 250% or 2.5x their minimum hourly rate for hours worked on a public holiday.

If an employee’s overtime continues after midnight into Sunday or public holiday, the overtime rate will not reset to 150% after midnight. Instead, the employee will earn the relevant overtime rate for Sundays or public holidays.

If an employee works on a public holiday, higher penalty or overtime rates may apply, depending on the applicable award, and in some cases this can be up to 250% of the minimum hourly rate.

Overtime pay for piece rate-based employees

Under the Horticulture Award, pieceworkers are generally not entitled to overtime pay when paid strictly by piece rate, provided minimum pay and record-keeping requirements are met.

Overtime for permanent salaried employees

Some modern awards and registered enterprise agreements allow permanent salaried employees to take time off in lieu (TOIL) instead of receiving overtime pay. Under a TOIL arrangement, an employee receives paid time off rather than an overtime payment for additional hours worked.

Importantly, TOIL is not automatically available to salaried employees. It can only be used where the applicable modern award or enterprise agreement specifically permits it, and the arrangement must comply with the conditions set out in that instrument.

Where TOIL is allowed, common award conditions may include:

- The employer and employee must mutually agree to the TOIL arrangement

- Timeframes for taking accrued TOIL are determined by the applicable award or agreement

- Some awards require written agreements for TOIL arrangements

- Any accrued but untaken TOIL must be paid out if requested by the employee, or on termination of employment

The method used to calculate TOIL also varies between modern awards. In practice, awards generally fall into one of the following approaches:

- Ordinary rate TOIL: One hour of TOIL is granted for each overtime hour worked

- Overtime rate TOIL: TOIL is accrued at the overtime rate (for example, time and a half for the first two hours, then double time thereafter)

- No prescribed accrual method: The award does not specify how TOIL must be calculated, and the employer and employee must agree on suitable terms

Because TOIL arrangements are tightly regulated and award-specific, employers should carefully review the relevant award or agreement before offering time off in lieu, and maintain clear records of hours worked and TOIL accrued.

Annualised salary arrangements

Some employers use annualised or “all-in” salary arrangements to compensate employees for expected overtime and penalty rates in advance. Where permitted by a modern award or enterprise agreement, these arrangements must ensure the employee is better off overall compared to their minimum award entitlements.

In practice, this often requires employers to track actual hours worked to confirm that the salary continues to adequately cover overtime and penalty rates, particularly during periods of increased workload. Without accurate time records, employers may struggle to demonstrate compliance if an underpayment issue arises.

Penalty rates in Australia

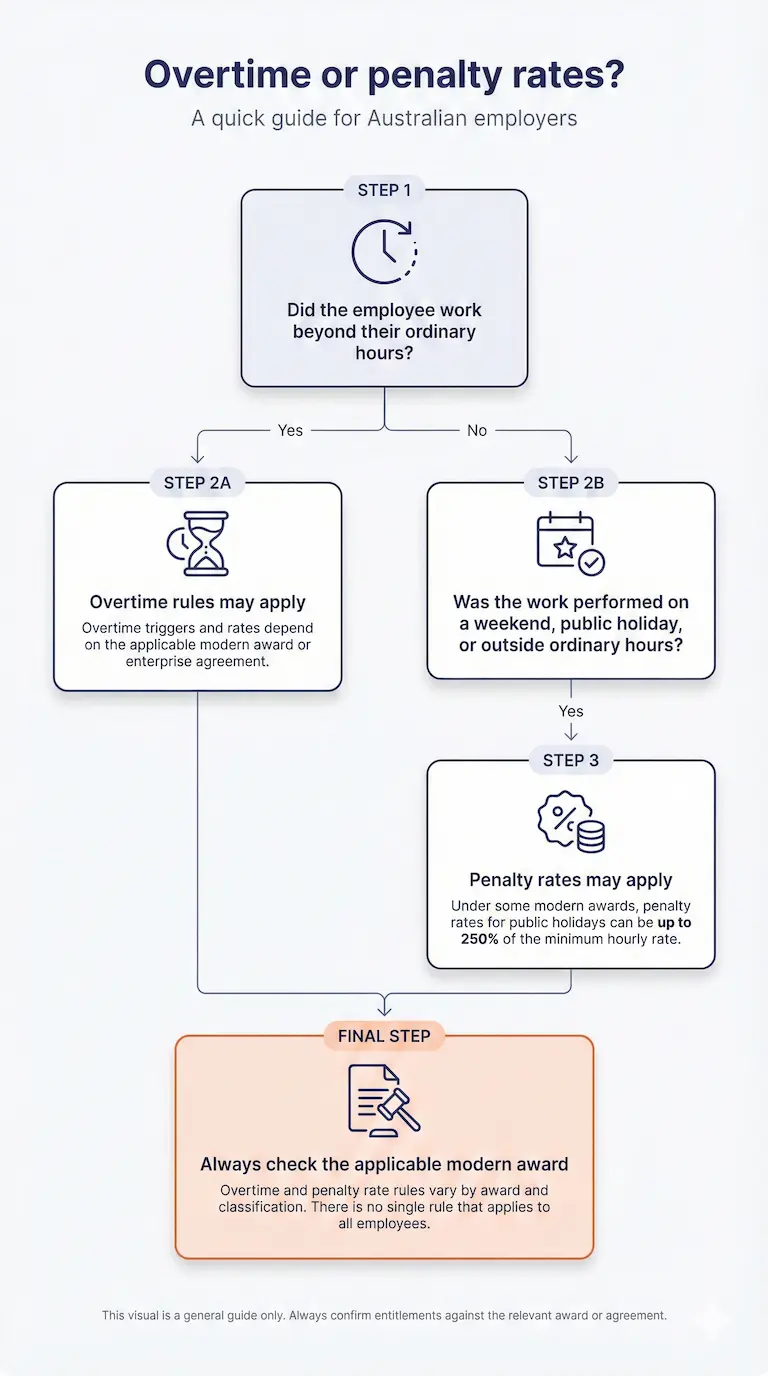

Penalty rates apply to when work is performed (weekends, nights, public holidays), while overtime applies to excess hours. Depending on the award, overtime and penalty rates may interact, but they do not always apply concurrently

The Fair Work Ombudsman defines penalty rates as higher pay rates employees receive when they work particular days or hours. An employee may be entitled to a penalty rate for working during:

- Public holidays

- Weekends

- Overtime

- Early morning shifts

- Late night shifts

This leads to the question, what is the difference between penalty rate and overtime? The most notable difference is that employees are entitled to overtime pay for additional hours worked beyond regular work hours.

But, there is no threshold or minimum number of hours an employee must work to trigger a penalty rate payment. Instead, an employee receives the penalty rate for working during specific times or days.

Use Timeero to streamline overtime compensation in Australia

Employee overtime pay is only as accurate as the recorded overtime hours. To avoid underpayment or inaccurate overtime payment, invest in a reliable time tracking app like Timeero. Read on to learn how Timeero automates time tracking to maintain compliance and accurate worker compensation.

Setting up an overtime policy is easy

Timeero makes it easy to implement the complex overtime rules in Australia. The app allows business owners to set up daily or weekly overtime rates and thresholds depending on the stipulations in the employee’s award.

Suppose you want to configure Timeero to track daily overtime on a standard workday. Go to “company settings” and open the “payroll and overtime” settings page. Select when the work week starts and set the overtime rate to 1.5 and double overtime to 2.

Unselect the “California overtime rule” button and set the overtime threshold to 7.6 hours and daily double time to 9.6 hours. Click “save” to apply the overtime policy — and that’s it.

If the employee award requires you to track weekly overtime, unselect the daily overtime and daily double overtime buttons. In the "Weekly Overtime" section, set the work week hours to 38 and click “save” to apply the weekly overtime policy.

Timeero’s time tracking is accurate

Once you configure your company’s overtime policy, Timeero enforces it for you to ensure full compliance. Employees don’t have to lift a finger to track overtime. They only need to clock in at the start of their shift and clock out at the end of their work day.

Timeero tracks and segregates employee work hours into regular, overtime, or double time hours. The good thing is that Timeero offers tools to prevent timesheet fraud and improve timesheet accuracy so that your company compensates employees for hours they actually worked.

For example, you can opt for employees to use facial recognition to clock in and out to prevent buddy punching. The app also lets you create virtual boundaries (geofences) around job sites to thwart off-site punching. Additionally, you can configure clock-in and clock-out reminders to ensure each employee tracks time during the designated window.

Computing employee overtime is hassle-free

Timeero saves you numerous hours you’d have spent trying to figure out each employee’s overtime pay. The app allows managers to add an employee’s minimum hourly wage to simplify overtime pay calculation.

The intelligent engine automatically calculates an employee’s regular, overtime, and double-time pay based on approved timesheets. At the end of the pay period, the manager simply generates a payroll report and forwards it to the finance department for easy employee payment.

Alternatively, you can export the reports directly to your payroll or accounting software to expedite payment. Timeero integrates with popular accounting and payroll solutions like QuickBooks, Xero, Gusto, Paychex, ADP, Paylocity, Viventium, and Rippling.

Other notable Timeero features

In addition to overtime tracking features, Timeero offers tools that enable you to streamline business operations and comply with strict labor laws. Some of Timeero’s notable features include:

- Break tracking

- Mileage tracking

- Segmented tracking

- Real-time location tracking

- Employee scheduling

Navigate complex overtime law with ease

In recent years, the Fair Work Ombudsman has significantly increased enforcement activity around wage underpayments, record-keeping failures, and misclassification of employees. Employers are now expected to maintain accurate time records, correctly apply award conditions, and proactively identify underpayment risks. In serious cases, breaches may be treated as wage theft, attracting substantial civil penalties and back-pay orders.

To fully comply with overtime law in Australia, you must interpret the stipulations correctly, create your company policy, and implement the right solutions to enforce provisions. Australia’s overtime law is complex, so we recommend seeking the guidance of a well-versed attorney if you have doubts about any requirements.

Mistakes in overtime compliance can result in significant civil penalties, enforceable undertakings, and mandatory back-payment of underpaid wages, particularly where breaches are deemed serious or systemic.

Keep in mind, an automatic time tracking app will help you to track overtime in accordance with the law. If you’re looking for a time tracking app that’s easy to implement and use, try Timeero.

Overtime pay in Australia: FAQs

How does overtime work in Australia?

In Australia, there isn't just one simple rule for overtime. Instead, it depends on the specific "award" or "agreement" that covers your specific job and industry.

While the national standard for a full-time week is 38 hours, the rules for when overtime starts and how much extra you get paid are set by your industry's specific rules.

Is there a legal threshold for overtime hours?

There is no single legal overtime threshold that applies to all employees. Although 38 hours per week is the NES benchmark for full-time employment, overtime may be calculated daily, weekly, or both, depending on the terms of the relevant award or enterprise agreement.

Is a 40-hour work week legal in Australia?

Yes. Employees can legally work more than 38 hours per week, provided the additional hours are reasonable under section 62 of the Fair Work Act 2009 and comply with the applicable award or agreement. The law focuses on whether extra hours are reasonable, not on a fixed weekly cap.

How do I know which award applies to my employees?

Award coverage depends on the employee’s role and the nature of the business, rather than job titles alone. Misidentifying an applicable award is a common compliance risk. Employers should confirm award coverage using Fair Work Ombudsman resources or seek professional advice, particularly where roles involve mixed duties.

Are salaried employees entitled to overtime?

Some salaried employees are entitled to overtime, depending on the applicable award, classification, and employment arrangement. Where annualised or “all-in” salary arrangements are used, employers must ensure the employee is better off overall compared to award entitlements, which often requires tracking actual hours worked.

What is the difference between overtime and penalty rates?

Overtime generally applies when an employee works beyond their ordinary hours. Penalty rates apply based on when work is performed, such as weekends, public holidays, early mornings, or late nights. Depending on the award, overtime and penalty rates may interact, but they do not always apply at the same time.

Do public holidays always attract 250% pay?

Not always. Many modern awards provide higher penalty or overtime rates for work performed on public holidays, and in some cases this can be up to 250% of the minimum hourly rate. The exact rate depends on the applicable award or agreement and should always be confirmed before processing payroll.

Do employers need to keep overtime records?

Yes. Employers are required to keep accurate time and wage records under the Fair Work Act. In underpayment investigations, regulators closely examine time records to assess whether overtime and penalty rates have been applied correctly.

.png)

.png)

.png)