Travel Time in California 2026: A Must-Know Guide for Employers

Understanding travel time pay in California is essential for employers. It involves complex rules and regulations that affect how you compensate your employees, manage your operations, and protect your bottom line. Get it wrong, and you risk costly lawsuits and unhappy employees, not to mention inefficient practices that will eat into your profit.

So, let’s get it clear from the get-go: Is travel time paid in California?

A short answer is yes, but you should know that not all travel counts.

To avoid the pitfalls of failing to comply with legal requirements, you should familiarize yourself with the ins and outs of travel time pay and mileage reimbursement in California.

Our guide is here to explain the concept of travel time pay, how it differs from regular pay, and what California state law stipulates.

We’ll also provide some practical tips on calculating California travel time pay and mileage reimbursement accurately and fairly.

Overview of California Labor Laws Related to Travel Time

When enforcing travel time pay, the California Division of Labor Standards Enforcement (DLSE) guidelines specify when you must compensate your employees for travel time.

So, what are the rules you need to follow?

What constitutes “hours worked” in California?

How California labor law defines, “hours worked” will determine whether or not you compensate employees for travel time.

By definition, “hours worked” includes:

- Time actively spent performing work-related tasks, such as sending emails, making phone calls, or visiting clients.

- Any time employees aren’t directly involved in work-related tasks, but are still supervised by management. This usually means the employee isn’t free to leave the premises or conduct personal business.

What specific guidelines govern California’s travel time pay?

California has established specific rules that determine whether or not employee travel time should be paid.

Below are basic rules that determine when and if travel time should be paid:

- The employer’s vehicle is used for travel. The time spent traveling is compensable if an employee has to use the company vehicle for work purposes.

- Carrying employer tools. If an employee transports tools or equipment for their employer, adding time and effort beyond the usual commute, that extra time must be paid.

- Alternate worksite reporting. If an employer assigns an employee to travel to a different job site on a short-term basis, and the commute covers a long distance, this travel time must be compensated.

- Special circumstances. Activities like education and training time may also count as “working hours” under certain conditions.

- Special rates. If an employer decides to pay a special rate for travel time, they must establish and inform employees about this rate in advance.

- Advance notice and minimum wage. Employees must be informed of the travel rate in advance, and this rate cannot fall below the minimum wage.

When should you compensate employees for travel time in California?

Let’s look at a few real-world scenarios when employees are entitled to travel time pay under California law:

- If your employees are making trips during work hours completing business-related tasks — for instance, traveling between different office locations or running errands for supplies, those hours are generally compensable.

- When an employee travels out of town for a business event and returns the same workday,you must reimburse the travel time.

- If employees are required to stay overnight for business purposes, the rules become more complex. Any time spent traveling during regular working hours is compensable, but travel time at the destination is not eligible for travel pay unless it’s spent working.

- If travel is a central part of the employee’s job (think sales representatives or delivery drivers), almost all the time spent traveling during work hours is compensable, including wait time at airports or other transit hubs.

- Mandatory attendance at training sessions or conferences also requires compensation for travel time. If the event is outside of regular work hours, but attendance is required, you must also reimburse your employees for travel time.

What is the difference between commute time and travel time?

Understanding the difference between commute time and work-related travel is important if you want to avoid legal complications.

You’re not required to reimburse your employees for the time they spend commuting to and from their regular worksites.

However, certain situations turn the usual commute into compensable work time.

- Employer-provided transportation. If an employee must come to the main office to use the work truck each morning and then travel to their regular worksite, that travel time is compensable under California law.

- Restrictions on personal transportation. If employees aren’t allowed to use their own transportation during work hours and must use company vehicles, then travel time is also considered work time that must be compensated.

The Morillion v. Royal Packing Co. case is an important legal ruling concerning travel time pay in California. The court determined that the employees who had to travel on employer-provided buses were entitled to compensation for their travel time since they were subject to the employer’s control and could not use that time for their own purposes. This case has important implications for defining what constitutes compensable work hours under California law.

Travel Time Pay and Mileage Reimbursement in California

If an employee’s job description requires using their personal vehicle for work-related activities, according to California Labor Code Section 2802, employers have to reimburse them, not only for fuel expenses but also vehicle wear and tear.

Keep in mind, if your employment contract states that employees waive their rights to mileage reimbursement, this provision is void in a court of law.

Although many employers rely on the IRS standard mileage rate for calculating reimbursements, it’s important to note that this is not a one-size-fits-all solution.

If an employee can prove that their actual expenses have exceeded the standard mileage rate, you must cover the difference. Failing to reimburse employees can result in costly wage and hour lawsuits.

A reliable mileage tracking solution such as Timeero, can help you accurately track and reimburse your employees for business mileage.

Legal Must-Dos and Best Practices for California Employers

Let’s explore the best practices your business can follow to avoid costly legal disputes.

Advanced time and mileage tracking

Timeero is one of the best employee GPS time and mileage tracking systems that will help you stay compliant with California labor laws. Automating mileage tracking provides you with precise mileage records for accurate reimbursement.

Up-to-date policies

Your employee handbook isn’t just a document; it’s your legal shield. Make sure it’s always updated with the latest company travel policy and mileage reimbursement policy.

This will keep your team informed and serve as your first line of defense in case of disputes or inquiries.

Regular audits

You shouldn’t wait to find yourself in legal trouble to examine your processes. Regular audits can serve as a preventative measure, offering a clear insight into any discrepancies that could snowball into serious legal issues. Think of it as your business health check-up.

Expert consultation

Regulatory changes sometimes happen without much notice. When in doubt, don’t hesitate to consult legal experts who specialize in California labor law. Remember, preemptive legal advice is often much more affordable than dealing with potential litigation or lawsuits.

How Can Timeero Help Employers Stay Compliant With California Travel Time?

Compliance with California’s travel time regulations is easier with Timeero.

Our comprehensive software offers a range of features designed to keep you in line with California state laws effortlessly.

Time Tracking

Timeero offers precise time-tracking functionalities that comply with California laws, capturing details of your employees’ work hours to ensure fair compensation.

Once your employees have downloaded the Timeero mobile app, they can clock in and out every day from their device. Timeero keeps track of all their work-related activities and automatically creates time cards with timestamps as well as the total number of hours worked.

Timeero only tracks employee time during work hours, so employee travel time is automatically included in timesheet records.

Timeero also allows you to set a different hourly rate for the jobs you create, giving you flexibility around the travel time rate.

Mileage tracking

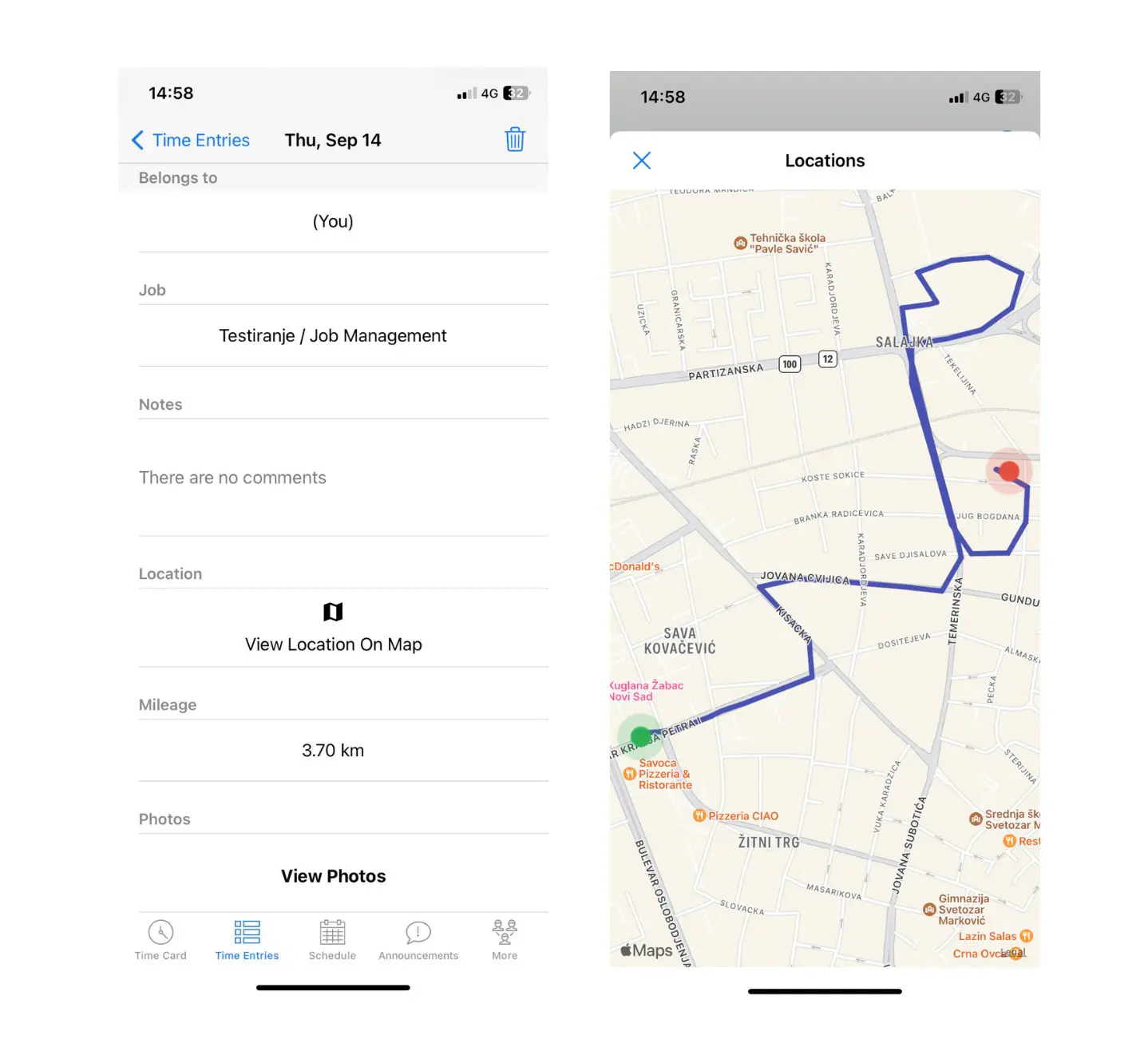

When employees use their own vehicles for work-related tasks, accurate mileage tracking is essential for reimbursement. Timeero’s GPS tracking technology makes it easy to track employee mileage in real time.

Once the app detects driving speeds, Timeero automatically starts tracking employees’ mileage and routes, capturing precise data for accurate reimbursement.

You can also use the app to replay employees’ driving routes and compare their actual routes with suggested routes to reduce travel costs.

Segmented Tracking

Timeero’s Segmented Tracking provides a clearer view of how employees spend their time during work hours.

Segmented Tracking gives you a quick overview of your employee’s travel time vs. time spent on site. If there are any potential issues when it comes to excessive travel time or mileage, you will be able to spot them right away.

California Overtime Settings

Timeero includes settings specifically designed for tracking California-specific overtime and double-time hours, helping you maintain compliance with state labor laws.

You can enable the California Overtime Rules feature in your company settings, set the overtime rate, and have the exact payroll data ready when the next paycheck is due.

California Breaks

During work hours, non-exempt employees in California are mandated to use their breaks. Not providing them with breaks leads to premium pay and potential legal and financial penalties.

Timeero’s California Breaks Tracker helps you ensure compliance with California meal and rest break laws, further reducing the risk of labor law violations.

With this feature, California workers must complete the Daily Sign-off form before clocking out from their shifts. This way, they verify whether they’ve used their breaks in compliance with California break law. Timeero will also automatically alert you if there is a compliance issue.

Disclaimer: California laws are complex. This article should be used for informational purposes only. Consult your legal team for personalized advice.

FAQ: Travel Time in California

Is there a law in California that says you should be paid for travel time?

Yes, it’s a legal requirement. Failure to comply with the California Labor Code and DLSE guidelines on travel time pay can result in legal actions, including penalties and back pay.

How many hours per day can be paid for travel time in California?

There’s no hard and fast rule for a “per day” cap on travel time. However, what counts as compensable hours varies based on travel, whether an employee travels for a one-day assignment or an overnight trip.

How much is travel pay in California?

In California, the rate for travel time pay is typically calculated at the employee’s regular rate of pay. But, in some cases, both sides may agree to a different rate for travel time before the travel takes place. The rate must be at least the minimum wage.

.png)

.png)

.png)