Illinois Mileage Reimbursement Law 2026 Explained

The ins and outs of mileage reimbursement can sometimes be complex to navigate. If you're an employer or employee in Illinois, you might be wondering about the rules surrounding this topic.

Paying back employees for mileage is a crucial aspect of business operations, especially for staff members using personal vehicles for work-related travel. Like a few other states, Illinois has its own set of regulations governing this aspect of compensation.

In this article, we'll cover the Illinois mileage reimbursement law, exploring whether employers are required to pay mileage and the methods to choose from. We’ll also make a comparison with the IRS standard mileage rate and look at how the best mileage tracking apps, like Timeero, can simplify the reimbursement processes.

Are employers required to pay for mileage in Illinois?

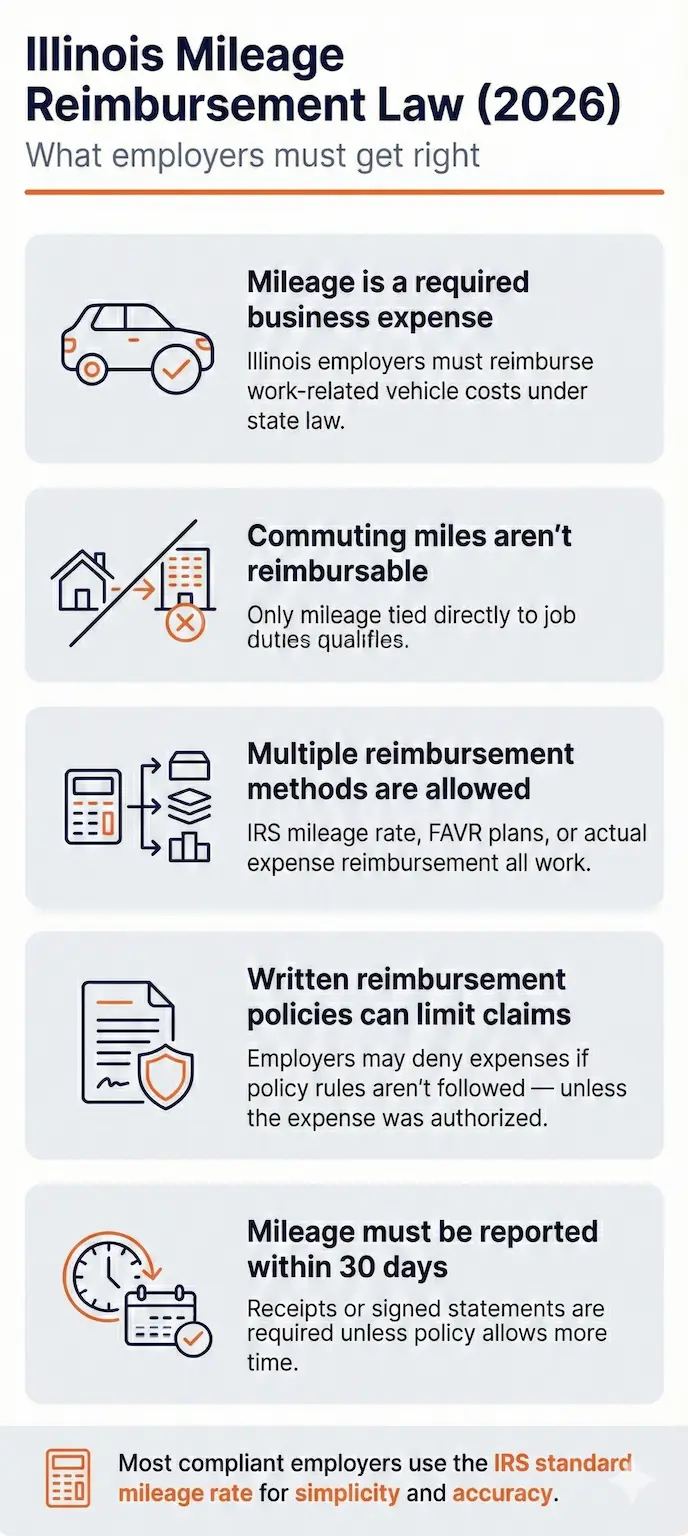

One of the most asked questions surrounding mileage reimbursement in Illinois pertains to whether employers are legally obligated to pay for mileage incurred during work-related travel using personal vehicles. The short answer is: yes, they are.

Employers are required to compensate their employees for business costs as per the Illinois Wage Payment and Collection Act (820 ILCS 115/9.5).

According to the law, employers should pay back an employee for “all necessary expenditures or losses incurred by the employee within the employee's scope of employment and directly related to services performed for the employer.”

This suggests that expenses associated with vehicles used for the primary benefit of the employer should be reimbursed to employees. Employers are exempt from paying expenses associated with:

- employee negligence

- normal wear and tear

- theft unless the employer's negligence was the cause

Employees must submit any necessary expenditures along with required supporting documentation within thirty calendar days of the incurred expenses unless an extension policy is in place. If the supporting paperwork is absent, misplaced, or nonexistent, the employee should provide a signed statement providing details about the receipts. An employee will not be entitled to reimbursement if they fail to follow the documented reimbursement policy.

The costs incurred become payable if the employer fails to adhere to the reimbursement policy, gives the employee permission to incur the expense, or does both.

A clear reimbursement policy is necessary to protect employer and employee interests. If you don’t already have one, you can customize our free mileage reimbursement policy template to suit your business needs and preferences.

There are several fundamentals you should include in your policy. One is the general principles of reimbursement, which should cover the definition of business mileage and what counts as reimbursable miles. To avoid any confusion, you can use the IRS definition and guidelines, which state that the trip must have a business purpose and be beneficial to the business and its operations.

Make sure you give concrete examples of reimbursable business trips. These may include meetings with clients, visits to work sites, trips to conferences, and drives to meet company suppliers.

You can also make it clear that a normal commute from home to work on a workday does not qualify for compensation. We cover this in detail in our commuting mileage reimbursement guide.

Another essential aspect of the policy should be how mileage reimbursement will be calculated. This includes the method used and the standard mileage rate to apply. There should also be clear guidelines on how employees should file a claim and other reimbursement requirements.

If you opt for manual methods of recording mileage, make sure to state what employees should include in their reports. They need to provide information like the time and date of the business trip, the reason for the trip, the miles covered, and the destination. A mileage tracking app is a better option for documentation purposes compared to mileage logs since it automatically collects this information.

What is the best way to reimburse your Illinois employees for using a personal vehicle?

Choosing your company’s preferred reimbursement method involves carefully considering various factors, such as your specific industry. Let’s cover some of the employee mileage reimbursement methods that exist:

The standard mileage rate

This is the simplest method you can opt for. The Internal Revenue Service (IRS) sets a standard mileage rate for business-related driving, which employers can use for reimbursement purposes.

The IRS mileage rate accounts for vehicle operating costs, including gas, depreciation, insurance, and maintenance. As of 2026, the IRS rate is 72.5 cents per mile for business travel. Illinois employers can adopt this mileage reimbursement rate, providing a fair and consistent method that aligns with state guidelines.

To quickly calculate reimbursement amounts based on the IRS standard mileage rate, you can use our free IRS mileage reimbursement calculator.

The FAVR (fixed and variable rate allowance) approach

The FAVR method of employee reimbursement separates costs into fixed and variable expenses. Fixed costs can include depreciation, insurance, and registration, while variable costs may include maintenance and oil. An employer then offers a set amount that covers the fixed expenses and a cents-per-mile rate for the variable ones.

The main benefit of the FAVR Method lies in its accuracy in reflecting real prices. Furthermore, rather than depending on federal or state averages, local prices are used to calculate compensation for gas prices.

Check out our FAVR car allowance guide to better understand this method.

The actual expenses method

The actual expenses method helps you determine the real cost of using a personal car for business. It comes down to adding up the expenses incurred when using the vehicle, including gas, tires, depreciation, etc. Learn more about these costs from our article on what mileage reimbursement covers.

This method is often accurate in compensating for mileage, as employers only pay back for what was actually spent. However, it requires meticulous record-keeping and may be administratively burdensome for employees.

How does the Illinois mileage reimbursement law compare to the IRS standard mileage rate?

The Illinois mileage reimbursement law and the IRS standard mileage rate are both crucial frameworks governing mileage reimbursement, but they operate at different levels and serve different purposes.

Illinois mileage reimbursement law operates at the state level, meaning it specifically pertains to businesses and employees operating within the state of Illinois. On the other hand, the IRS standard mileage rate applies nationwide for tax purposes. It is designed to provide a simplified method for calculating deductible vehicle expenses for business use.

While the IRS standard mileage rate provides a convenient option for business owners, it is not mandatory. Employers have the choice to use the standard mileage rate or calculate actual expenses using the actual cost method, depending on which method results in a higher deduction.

This is not the same case for the Illinois mileage reimbursement law. This law applies to all employers and employees within the state, and going against it can lead to legal repercussions.

How does Timeero help you reimburse employees fairly?

Traditional methods of tracking mileage often involve cumbersome manual processes, such as paper logs or spreadsheets. These methods are prone to errors, omissions, and inconsistencies, leading to disputes and inaccuracies in reimbursement claims.

Without a reliable system in place to track mileage and ensure compliance with state regulations, employers also risk facing legal liabilities and penalties for non-compliance. This is essential in states that require mileage reimbursement like Illinois, California, and Massachusetts.

This is where Timeero comes in – a leading GPS mileage tracking app. Let’s take a look at the features of this software:

Real-time GPS and mileage tracking

With Timeero, you can effortlessly keep tabs on your team and ensure they're logging their mileage accurately. You can enable mileage tracking for the employees on the move.

The app starts recording mileage when the speed exceeds 4.47 miles per hour. You can also tweak this threshold to your liking in your account settings. This customization option ensures that walking doesn't get counted towards mileage.

Every 150 feet of movement triggers the app to log GPS coordinates and timestamps, ensuring precise tracking. Even in areas with patchy network coverage, Timeero's offline mode guarantees mileage tracking, leaving no trip unrecorded.

With the Who's Working feature on Timeero, you can effortlessly monitor your team's whereabouts and clock-in durations. It shows you exactly where everyone who is clocked in is, making it easy to respond to emergencies and make impromptu changes.

Segmented tracking for accountability

With Timeero's segmented tracking functionality, you can obtain a detailed summary of your staff members' workdays. When a worker moves locations, the system automatically records the distance traveled and gathers GPS data for every site.

This implies that the mileage of each site visit is accurately recorded without requiring human involvement. Important details like the length of the drive and the arrival and departure times for each place will be provided.

After your account has been set up for segmented tracking, you can view your employee's segments under Timeero's Time and Mileage tab. You can register jobs on Timeero that match up with specific areas for segmented tracking so that the job is displayed instead of the GPS position. This comes in handy when you’re verifying mileage covered.

Adding extra expenses for reimbursement

Timeero allows businesses to track toll expenses independently, enabling them to manage every aspect of mileage reimbursement.

Because employees have the option to attach a note or a photo of the receipt to their timesheet, they can ensure that all employee expenses are recorded. An admin can view the note that an employee adds to their timesheet and approve the business expense.

Charging for mileage

The next stage after tracking mileage is to calculate how much you're paying back your workers.

In Timeero's account settings, you have the option to set a per-mile rate that provides you with the total. As a result, extra mileage calculations are not necessary.

Better yet, you can adjust this to match your company's location by selecting the local currency. Eliminating the need for manual computations after each trip saves you time and helps to avoid human error.

Reports for compliance

The amount of mileage an employee travels during a shift is detailed on each Timeero timesheet. It also contains details about clock-in and clock-out times, the total hours worked, and any overtime and breaks taken.

You can also access other crucial reports for your company, such as mileage tracking reports. These reports are very important when you're applying for tax deductions or during audits.

Integrations with payroll solutions

Payment processing does not have to be a time-consuming task. Timeero automates employee mileage reimbursement once you calculate the overall cost of mileage.

The software allows you to make payments quickly and easily through the integration of multiple payroll and invoicing platforms. These include:

- Zapier

- Vieventium

- Paylocity

- QuickBooks

- Gusto

- Xero

- ADP

- Paychex

- Rippling

.webp)

Choose Timeero for Illinois mileage reimbursement

Understanding Illinois mileage reimbursement law is essential for both employers and employees to ensure fairness and compliance. Employers can make informed decisions that benefit everyone involved by exploring various reimbursement methods.

Additionally, leveraging innovative solutions like Timeero can streamline the reimbursement process. From automated tracking, comprehensive reporting, to integration with payroll systems, this app offers a great way to save time and reduce administrative burdens.

FAQ

Is mileage reimbursement mandatory in Illinois?

Yes. Illinois law requires employers to reimburse employees for necessary business expenses, including work-related mileage when personal vehicles are used for job duties.

Does Illinois require employers to use the IRS mileage rate?

No. The IRS rate is optional. Employers may use the IRS standard rate, a FAVR plan, or reimburse actual expenses — as long as employees are fully reimbursed for business-related vehicle costs.

Is commuting mileage reimbursable in Illinois?

No. Normal travel between home and a regular work location is not considered a reimbursable business expense. Only mileage tied directly to job duties qualifies.

Can an employer deny mileage reimbursement?

Yes, if the employee fails to follow a written reimbursement policy. However, authorized business expenses must still be reimbursed under Illinois law.

How long do employees have to submit mileage expenses?

Employees must submit mileage and supporting documentation within 30 calendar days unless the employer’s written policy allows more time.

.png)

.png)

.png)