Automate your QuickBooks mileage

Save hours on payroll, billing, and reporting. See why Timeero’s seamless integration and accurate, automatic tracking make it the top-rated mileage app for QuickBooks users .

If you're considering QuickBooks Time for mileage tracking, here’s what you need to know. It works well for teams that drive continuously between locations, but if your field employees also walk between stops, such as sales reps, healthcare workers, and construction crews, our testing showed the app may overcount mileage, potentially costing you thousands annually. We’ll show you the data and help you decide if it's right for your operation.

If you’re using QuickBooks for accounting, QuickBooks Time (formerly TSheets) seems like the natural choice for mileage tracking. It's already integrated, your data syncs automatically, and your team knows the system.

We've been testing QuickBooks Time's mileage tracking for years. Early versions had issues connecting starting and ending points and actual routes were found to be missing entirely. By 2023, Intuit’s upgrade to breadcrumb-based tracking considerably improved the accuracy of mileage tracking.

But how accurate does QuickBooks Time capture mileage for field-based teams?

In this review, along with our usual tests, we also tested the accuracy of mileage tracking for mixed fieldwork teams, where employees drive to a location, then walk between stops or around job sites.

Our results revealed some important differences worth knowing about.

Yes. QuickBooks offers mileage tracking through QuickBooks Time (formerly TSheets, acquired by Intuit in 2017).

In June 2023, Intuit merged QuickBooks Time with the QuickBooks Workforce mobile app into a single employee-facing application. With QuickBooks Workforce, employees’ mileage is automatically tracked as soon as they start driving, and is continuously recorded throughout the duration of travel.

Important note: To activate mileage tracking, you must be enrolled in the Elite plan ($40/month base + $10/user) and have a QuickBooks subscription.

.webp)

QuickBooks Time streamlines mileage tracking for employees:

We've tested QuickBooks Time's mileage tracking feature multiple times, tracking its evolution from undercounting on winding routes to significantly better accuracy after the breadcrumb tracking upgrade.

In addition to testing continuous routes, our September/ October 2025 test also included more complex, real-world scenarios—the kind many field teams experience daily.

We conducted an 8.5-hour field shift test designed to replicate mixed field work conditions:

What the test involved:

Our previous tests showed QuickBooks Time tracked around 85-86% of actual mileage on continuous driving routes, which is acceptable for most business purposes. The variance came from GPS sampling intervals rather than fundamental issues.

However, we wanted to test a more realistic scenario. Our October 2025 field shift test revealed important differences in how mileage tracking apps handle mixed work conditions.

Throughout the 8.5-hour shift, we drove between several job sites, worked on-site for extended periods, and walked around those locations—typical working conditions for field employees.

Understanding the difference in speed filtering

QuickBooks Time uses built-in speed filtering to exclude walking from mileage calculations. According to their documentation, walking shouldn’t typically count toward mileage, however, our testing showed that extended movement can accumulate enough distance to register as mileage.

Timeero takes a different approach. It uses configurable speed thresholds (typically around 5 mph) combined with more aggressive motion-detection technology to exclude non-driving travel from mileage calculations. The app only counts mileage when it detects a sustained driving speed, which more effectively filters out walking and on-site movement.

Who this affects

For teams that drive continuously between service calls, QuickBooks Time should work well.

During our October testing, we encountered another GPS reliability issue worth mentioning.

During a 5-hour shift, QuickBooks Time's GPS location locked onto a specific point and remained frozen at that incorrect location for several hours until clock-out.

This type of GPS behavior can impact dispatching, client verification, and route accountability. To make sure QuickBooks Time meets your operational needs, make sure you test GPS reliability during your trial period.

✅ Seamless QuickBooks integration. Time and mileage data flows automatically into QuickBooks for payroll and billing

✅ Automatic drive detection. Employees don’t need to start/stop tracking manually

✅ Reliable offline mode. Continues tracking without an internet connection and syncs when reconnected

✅ Team-wide tracking. All employees can log mileage

✅ Comprehensive workforce management. Includes scheduling, time-off management, and approval workflows

✅ Strong reporting. Detailed insights for job costing, payroll, and budget management

❌ Speed filtering may not be sufficient for field work. Our testing showed it may capture extended on-site movement, potentially inflating mileage for teams that walk between locations

❌ Higher cost. Mileage tracking comes with the Elite plan($40 base + $10/user), plus QuickBooks subscription

❌ Limited route detail. Some sampling gaps may still appear in areas with a poor signal

❌ No user-configurable motion settings. Can't adjust speed thresholds or filtering sensitivity for your specific use case

❌ No advanced mileage features. Lacks route optimization, commuter deduction, or segmented multi-stop tracking

❌ No specialized compliance tools. Missing features like EVV or HIPAA compliance for healthcare teams

.webp)

QuickBooks Time offers two paid plans:

QuickBooks Time vs Timeero for 10 employees:

QuickBooks Time offers a 30-day free trial for existing QuickBooks users.

Timeero is a comprehensive workforce management platform with GPS time and mileage tracking, scheduling, PTO management, reporting, and custom fields.

The key difference between Timeero and QuickBooks Time is by far Timeero’s GPS mileage tracking capabilities, as well as several specialized features QuickBooks Time lacks.

Timeero’s core workforce management features:

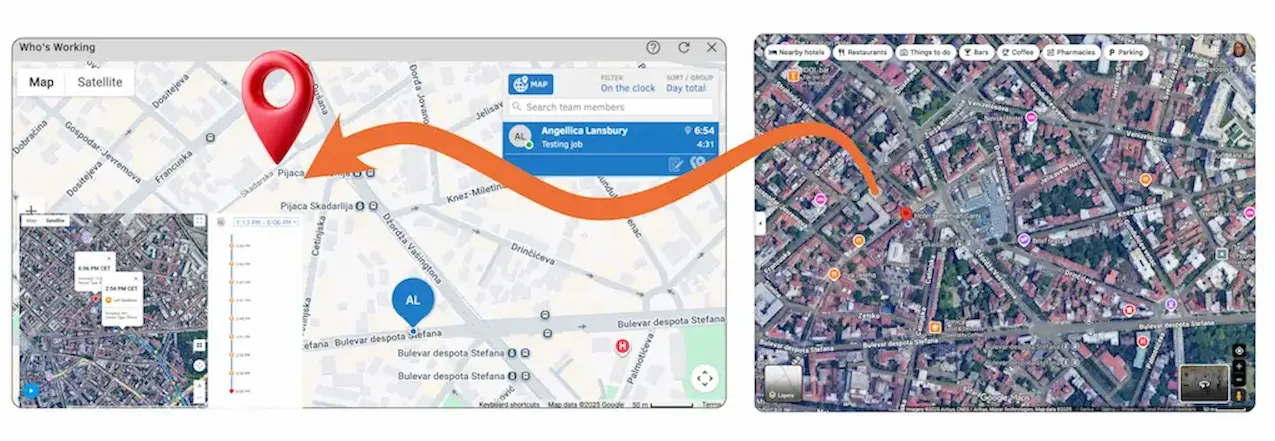

Timeero captures every GPS point for detailed route replay. It uses motion detection to distinguish between actual driving and other movements. The mobile app only counts mileage when employees reach driving speed (typically 5+ mph), automatically filtering out walking around job sites, equipment movement, and on-site activity.

You can set each employee’s home-to-office distance once. Timeero will automatically deduct non-reimbursable commuter mileage, ensuring you only pay for actual business travel.

Sales reps and service technicians often visit multiple clients in a single shift. With standard mileage trackers, they’d need to clock in and out at each location to capture the time spent with each client, as well as miles traveled.

Timeero’s Segmented Tracking technology allows employees to clock in once at the start of their shift while the app automatically divides their total driving route into segments based on stops made. Segmented Tracking automatically calculates the miles traveled between each stop, the total time your reps or technicians spent at each location, along with the total mileage and hours worked during the shift.

Note: Timeero’s Segmented Tracking is offered as an optional add-on.

Timeero analyzes your team's historical driving routes, identifying opportunities to reduce mileage costs. If an employee consistently takes the long route to a regular customer’s location, Timeero will suggest the shortest path to the destination and show potential mileage savings.

With Timeero’s Route replay and GPS breadcrumbs, you can verify whether employees took the most efficient routes, made unauthorized stops, or deviated from their assigned paths.

Timeero lets you generate detailed mileage reports in seconds. You can export time and mileage to PDF or Excel, or push data directly to QuickBooks Online. All reports include the date, purpose of travel, start/end locations, and total mileage – everything the IRS requires.

Choose QuickBooks Time if:

Consider Timeero if:

Ready to see how accurate mileage tracking should work?

Start a 14-day free Timeero trial—no credit card required. Test it alongside your current mileage tracking software to see the difference for yourself.

During your trial, you’ll have access to:

QuickBooks Time uses automatic GPS tracking with built-in speed filtering. When employees are clocked in, and the app detects movement above certain speed thresholds, it begins logging mileage based on GPS coordinates throughout the shift.

It depends on your use case. For continuous driving between locations, QuickBooks Time performs reliably. For field work involving walking between stops, our testing showed that it captured 40% more mileage than Timeero due to the speed-filtering limitations covered earlier. If your team walks between locations while clocked in, this affects your reimbursement costs.

Yes. The app improvements brought breadcrumb-based tracking that captures frequent location points to better reflect actual routes traveled.

Based on our testing, Timeero consistently achieves over 90% accuracy by using motion detection to distinguish actual driving from walking or other movement. It captures complete routes with detailed breadcrumbs following actual road paths.

QuickBooks Time Elite costs $40/month base + $10/user, plus a QuickBooks subscription is required. For 10 employees, expect around $140/month plus your QuickBooks subscription cost.

Yes. QuickBooks Time is part of the QuickBooks ecosystem and automatically syncs mileage data for payroll and billing. This integration is one of the platform's key advantages.

Yes. Timeero exports mileage reports directly to both QuickBooks Online and QuickBooks Desktop as billable expenses, bills, or invoices.

Andjelka is a researcher and writer with 7+ years in digital marketing. Her background in social work and journalism has sharpened her skill in connecting with people from all walks of life. For the past 4 years, she’s specialized in time, location, and mileage tracking. Outside work, she enjoys yoga, swimming, and unwinding with her cats while listening to Leonard Cohen’s music.

%202.svg)